Key Metrics to Review for Profitability

Now let’s look at different key metrics you may want to review and have in place for 2015. Understanding which key metrics you should be tracking and measuring is critical to remaining profitable as a solo and small firm attorney.

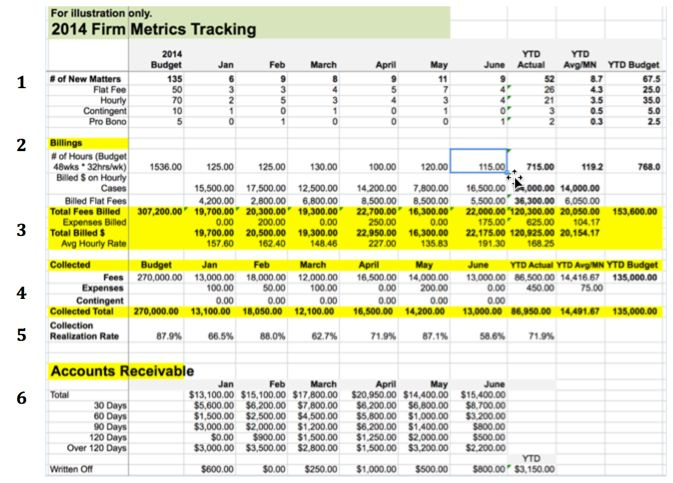

Using the below chart as a reference, here are six key metrics you should track for 2015. If you think six is too many to identify and track, then pick three. If you have never set up a way to track and review these key metrics, this spreadsheet will help you get started.

- Track the number of new matters you are getting by type: flat fee, hourly, contingent, and pro bono

- Track the number of hours you are billing on hourly cases and flat fee cases

- Your average hourly rate on billed matters

- How much you collected each month (revenue from cash flow worksheet)

- Your collection realization rate: what % of billed revenue did you collect

- Money not coming in: How much money are you leaving on the table every month

1. New matter tracking. How many new matters did you set up each month and what has been the trend? Did the pipeline stay full for continued cash flow? If you have good law practice management software, this information will be right at your fingertips by running reports.

One thing you want to look at is the balance between your types of cases. Too many contingent cases will create very uneven collections since these cases have a long life. They also have expenses related to them. Hourly cases should be generating a nice flow of income as long as you are billing regularly. If you do a number of flat fee cases, it’s important to make sure you are not only profitable but you are profitable at a decent hourly billing rate. Flat fees also mean you may have to manage the flow of this money between your trust account and your operating account, creating invoices and paying yourself at certain milestones. Pro bono cases should be one of your yearly goals as part of your business development plan.

Tip: If you do a lot of contingent cases and find your monthly cash flow having too many valleys, open up a firm savings account and deposit a portion of your next contingent fee in this account. Move it over to your checking account as needed to cover your monthly “nut.”

2. Billings each month. Knowing how much you billed each month and further broken down by hourly and flat fee will help you visually see how your billing processes are working. Knowing how much you billed every month and what the trends were in 2014, may help you identify another weakness to improve upon in 2015. A good law practice management system will have this data available.

3. Average hourly rate. You quote an hourly rate. You bill at that hourly rate. You have flat fee cases thrown in the mix. Doing the math and seeing your actual average billing rate could be interesting data to review.

What may affect this key metric?

- Are you discounting bills at the time of billing? Don’t discount too quickly and assume the client will have sticker shock. If the client asks for a discount upon receiving the bill, then you can entertain adding a discount.

- Not entering your hours on flat fee cases will over-inflate this rate.

It’s a simple math equation: Total Hours entered for the month/Total dollars billed

4. Money collected. The number that you are watching every day and maybe losing sleep over every night. This is the number that needs to equal your monthly “nut” each month. This key metric may be the one you watch the closest, but keep in mind #1 – #3 are affecting this number. You can’t collect if you aren’t billing regularly.

5. Collection realization rate. The key metric that I believe provides a clear picture of why your revenue numbers may be low. You are doing everything right in #1 – #4, but you are not profitable.

The financial health of your law firm or any business is ultimately dependent on three simple concepts:

- Getting the work

- Doing the work

- Getting paid for the work

You need to keep a steady flow in all three components and monitor your results to make sure your business is financially healthy. Envision a pipeline with a steady flow of water. At any point in the pipe when the source of the water slows down, a clog occurs in the pipe or even a leak, the output will be affected. All 3 have to work together in order to keep a steady flow.

Your ability to collect what you billed is not only a financial indicator but quite often it is a measurement of your client’s satisfaction with the work product. So at the heart of it, the collection realization rate and the rate of payment are a direct correlation to your client’s level of satisfaction and your profitability. Happy clients pay their bills.

Your collection realization rate is the percentage of your billed fees that were actually collected. Pretty simple math.

Billed Fees/Collected Fees = Collection Realization

6. Money stuck: Bills past due, which is your accounts receivable. Looking at these numbers can be quite painful for a few reasons because it may reveal:

- Your procrastination during the year, not calling clients who owe you

- Not trusting your gut on client selection

- Not billing regularly

- Lack of a good billing system

Whatever the reason may be, having this information to review is an opportunity to make improvements in 2015. This is an area that can yield you additional profits without putting in longer hours, by simply tightening up or putting in place good receivable management practices. You are not in the business to extend credit and make loans. Set expectations with your clients early on regarding payment of invoices. You are a small business owner and cash flow is important. They should understand and respect your business needs. If they don’t, fire them.

Do now: One thing you can quickly do is analyze past due accounts in excess of 1 year. They have little chance of being collected. So don’t count on this money coming in. Write it off and move on.

Reviewing this data for 2104 and then understanding these financial metrics for 2015 will assist you greatly with strategic business development initiatives–all of which are critical to remaining competitive and profitable as a solo and small firm attorney.

I am co-owner of CPN Legal, a company whose mission is to help solo and small-firm lawyers build better businesses. I am active in the ABA GPSolo Division, where I head up the technology committee and am vice-chair of the national conference committee. Follow me on Twitter @PeggyGruenke.

CPN Legal GPSolo Technology Committee, Chair | GPSolo National Solo & Small Firm Conference Committee, Vice Chair