This summer we are digging into the tools you have in your pocket to help you better understand your firm’s profitability. In case you missed parts I and II of our series, you can find them here:

This month we are focusing on forecasting your cash flow. Your CPN Legal team can help you better understand your cash flow with a customized report specific to your firm and your needs. The most important takeaway is that checking your invoice balance is not current with your bank balance. There may be uncleared checks and uncleared deposits not reflected in this number. There are many moving pieces that go into understanding your cash flow.

A cash flow report tells you your beginning operating account (and other cash accounts) balance, money expected to come in and then money expected to go out. A cash flow report contains:

- Operating Account balances for the begging and end of the report period

- How much money will be collected (WIP and A/R)

- Upcoming expenses to be paid

- Monthly Nut

- Utilization rates

Cash flow reports force you to look at your business on a weekly basis. By doing this, you will have a better understanding of:

- Projected revenue for the reporting period

- Your expenditures

- What’s going out the door and when?

- Is there enough cash to cover these expenses?

- Potential problems ahead

- Is WIP low?

- Do you have a large potential expense the same week of payroll or rent? Usually these are the largest monthly expenditures for law firms.

- Your current A/R numbers

- Are you actually collecting the money due? If not, we can help make a plan to make it happen.

- Credit Card balances –

- And when payments are due.

- Trust fund balances

Two areas to focus on in your cash flow report are WIP and A/R.

Let’s spend a minute on WIP, or Work in Progress. WIP is your future revenue for cash flow. WIP helps look forward (the cash in your cash flow) and combines it with the money in Trust (revenue for the next billing cycle) and can help create billable goals. Your WIP is a key indicator to the strength of your cash flow. If there is a lot of flat fee billing, WIP does not exist. But, you still need a way to help project future revenue. This comes down to tracking the number of flat fee cases you have in the door every week.

You’re A/R is another key indicator for the strength of your cash flow. The goal should be that no money is in the 91+ days column of any A/R report. Being able to reduce your A/R means you can generate more cash for work you’ve already completed.

The key to reducing your A/R is to set yourself up for success with clients from the beginning. Your best tool is your Initial Meeting and a great fee agreement. This allows you to set the stage to have a little more control over when and how you get paid.

- Vet your clients. During your consultation process determine whether the client’s needs and expectations can be realistically met by your team.

- Make sure your client understands the cost of their case and the timeline at which they will be expected to pay in relation to their case. Finding out someone’s ability to pay must be done at beginning of the relationship

- Get Retainers and explain how they work to the client. You’d be surprised how many clients don’t understand retainers and trust accounts.

- Consider Evergreen Retainers and have a process in place to process these efficiently.

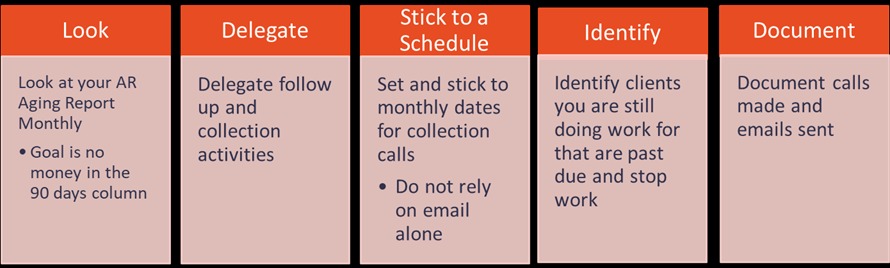

Here’s a few good tips to reduce your A/R:

Have a question about your cash flow or want to learn more about how this report can help you succeed? Our team customizes each report to your needs, no two cash flow reports look the same. CPN Legal has great resources to help you build your reports and to understand them. In understanding your data, you have a better idea of what steps to take next to help your business grow and thrive

Need to reach out? Contact us here or reach out to Nicole Tedford at nicolet@cpn-legal.com.