MyCase – Trust Accounting Basics 1

We all know mismanaging a trust account can have terrible consequences. However, while it seems to be discussed in theory, most attorneys receive little or no training on how to manage a trust account before opening one of their own. Law schools don’t address this in enough detail based on the blank look I often get when I mention trust accounting to new graduates.

All of which begs the question, “Are your trust accounting practices sufficient?” This ebook will help you answer this question and demonstrate some best practices for handling your trust accounting transactions.

Many states have rules in place regarding how attorneys must maintain lawyers’ trust accounts. These rules vary from state to state but the common underlying theme is that as a lawyer, it is your job to act as a fiduciary of client funds. Most states have adopted Rules of Professional Conduct to help guide you in the maintenance and recordkeeping requirements related to client trust accounts. Please refer to your individual state rules. This chapter is not intended to cover all rules related to handling and maintaining trust accounts. But it is intended to educate you on how to handle your trust account transactions and help you abide by any state imposed rules.

The fundamental aspects of a lawyer’s duty, related to handling client funds, include:

- Identification: Deposit funds into an account specifically labeled as a trust account

- Segregation: Keep client funds on deposit separate from lawyer’s own funds

- Accounting: A lawyer must create and maintain appropriate records of funds belonging to clients

In addition to these fundamental duties, some states impose additional specific duties upon a lawyer handling client funds. Below are a few of these duties your state may impose.

- Duty to pay promptly the funds to the client or otherwise owner of the funds

- Duty to notify the client upon receipt and deposit of funds

- Duty to maintain a separate ledger sheet for each client who has funds on deposit in trust account

- Duty to maintain complete, accurate records relating to the client funds which includes: amount of funds received and deposited, the amount of funds lawyer has paid or distributed out of the client’s trust account and the amount of funds still held in trust

A few terms related to trust accounting and your fiduciary responsibilities

There are a few terms used when discussing fiduciary duties and trust accounts that you should recognize and learn what conduct pertains to these terms. Two terms to review and understand are commingling and misappropriation.

COMMINGLING

Commingling means to intermix or put together without separation or segregation. In a legal directory, “commingling of funds” is defined as “the act of a fiduciary in mingling funds of his clients with his own funds.” As a lawyer, when you mix client funds with your own funds you will be subject to disciplinary action.

In the context of a lawyer’s trust accounting duties, commingling can occur in three different ways. The first is when a lawyer deposits money identified as a retainer or advanced payment for work the lawyer will conduct on behalf of the client in the near future into the lawyer’s personal or business account. The second is when a lawyer fails to deposit money belonging to a client, for example, settlement funds, into the lawyer’s trust account. And the third is when a lawyer deposits his funds, money already earned for legal work, into the lawyer’s trust account.

In summary, commingling occurs when client funds–funds not yet earned–are combined with the lawyer’s normal business funds. For example, you receive a retainer for a divorce case or business transaction and you deposit this money into your business operating account. This money is not yet earned and needs to be deposited into the trust account and labeled as belonging to the client.

Commingling also occurs when a lawyer uses the money in the trust account to pay for normal business expenses. The money in the trust account should never be used to pay for business-related expenses. If you find your operating account running low, then evaluate your unbilled time to see if you can invoice client(s) for work completed and transfer funds from the client’s trust funds to your operating account.

If you overdraw your trust account, this constitutes commingling. Besides facing disciplinary action because of an overdrawn trust account, you have quite an accounting mess to straighten out to get everything put back in place to produce accurate accounting records for the funds in trust.

Lastly, there are potential problems that can arise when a lawyer deposits client money received for fees already earned into the trust account. The basic rule of thumb is that if the money being received is payment on an invoice the client received for work already performed, this money must go into the operating account. Likewise, once the lawyer earns the fee by performing the work (and the client agrees to the charges and fees), the lawyer has an immediate right to the funds on deposit in the client’s trust account that are intended to pay the fee. And, if the lawyer fails to promptly withdraw these earned fees from the trust account, the lawyer is commingling his funds (the earned fees) with client funds.

MISAPPROPRIATION AND CONVERSION

When a lawyer takes or uses client funds, or funds of another, without express authorization, the lawyer misappropriates the funds. So if you “borrow” some money out of your trust account and pay it back later, you are misappropriating funds. Misappropriation also happens when a lawyer adds additional hours to a client invoice for time not spent on the case. Likewise, charging a client for an expense never incurred and receiving payment for that amount is misappropriation of client funds.

You can also misappropriate funds by simply failing to deposit client funds into a trust account. For example, if you receive an advance for fees you have yet to earn and deposit these funds into your operating account instead of a trust account, you have misappropriated client funds. “Advanced fees are client fees until the lawyer earns the fees.”

What happens when a lawyer withdraws funds from a trust account to pay the fees the lawyer has earned but the client then disputes the fees and thus the lawyer’s right to receive the fees? This is misappropriation. How do you prevent this from happening? Be sure to include in your fee agreement your billing practices and state how money held in trust will be withdrawn to cover the fees and expenses on the bill.

Setting the stage for understanding trust accounting

Before reading further, let’s set the stage by asking a few questions about how handling client trust funds.

- Do you reconcile your Trust bank account every month?

- Do you know what three-way trust account reconciliation is and how to complete one?

- Do you provide your clients with a monthly report showing detailed information about their trust account transactions, including how their money was used to pay for fees and/or expenses and balance remaining?

- Do you accept credit cards for retainer payments? If so, where are these funds deposited and how are the credit card fees paid?

- Do you put all retainers into your Trust account?

- Do you keep a separate client ledger for each client’s money held in trust?

- Do you allow and state that the client has the right to review fees and expenses before using the money in the client trust account to pay for these items? (Put this language in your fee agreement.)

- Do you file an annual unclaimed funds report with your state which includes all outstanding checks written but not cashed? In some states, unclaimed funds held in lawyer trust accounts

must be reported.

Review of duties and best practice tips

When a lawyer receives money from a client and this money is an advance payment of fees or money related to a settlement, under common law there are obligations related to how a lawyer handles this money that does not belong to the lawyer. You are holding this money in trust and this also puts you in the position of being a fiduciary. As a result, fiduciary duties arise including the duty to safeguard the assets, to segregate them from your personal or business funds, and to be accountable to the client regarding how these funds are used. Here is a summary and explanation of some of these duties.

DUTY TO KEEP SAVE AND IDENTIFY TRUST FUNDS

A lawyer satisfies this duty when the funds are deposited into a clearly identified and labeled trust account. When you set-up your trust account at your local bank, check with your state’s governing body as to how the account should be set up and registered. In Ohio, for example, after the account is established at the bank, the lawyer needs to register the account with the Ohio Legal Assistance Foundation and the taxpayer identification number on the account is that of the Ohio Legal Assistance Foundation. The bank then has the duty to pay the earned-interest to the OLAF and not keep this interest in the bank account.

To minimize the risk of inadvertently depositing trust funds into the operating account, you should have deposit slips clearly and conspicuously labeled with the account title “Law Firm ABC TRUST ACCOUNT FUNDS.” You should also have the checks for the trust account printed in a color different the operating account.

Some lawyers take the safeguarding process one step further and establish trust accounts with a different bank other than the bank where the lawyer maintains the business operating account.

DUTY TO SEGREGATE AND MAINTAIN SEPARATE LEDGER FOR EACH CLIENT’S FUNDS

This is your duty to keep client funds separate from firm operating funds. You will set up one trust account with your bank to deposit multiple client funds. This is called “pooled” funds in your trust account.

However, if you are going to be holding in trust a large amount of money for one particular client for more than a brief period of time, and this money has the ability to earn interest (in excess of the cost to establish and administer the separate account) to benefit the client, then you need to deposit these funds in a separate trust bank account for this client.

For “pooled” funds, you must keep in mind that each client’s funds are managed separately and must be segregated by client maintaining a separate log or ledger sheet for each client who has deposited funds.

You can set up these ledgers up in an Excel spreadsheet, in QuickBooks or other accounting software. Client A’s funds have nothing to do with Client B’s funds but together they equal the total amount in your trust account.

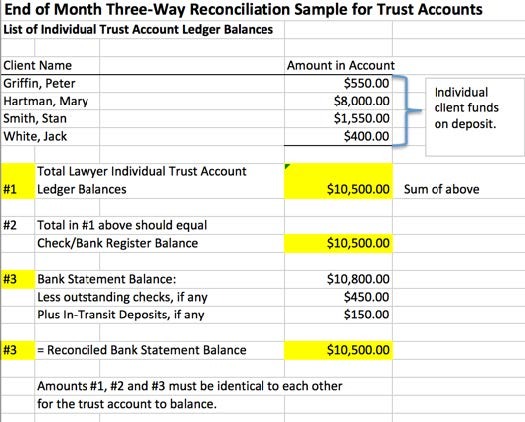

Below is a sample of a three-way reconciliation in Excel, which we will review in more detail. But for now, notice how the individual client ledger sum equals the total of your trust account balance.

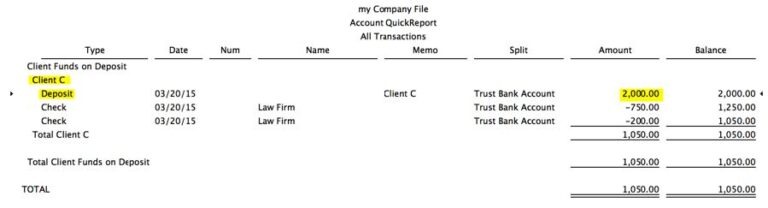

Below is a sample of using QuickBooks to properly manage your trust funds. Notice the three things that need to be equal are indeed equal.

- The bank account

- The Client Funds on Deposit total

- The individual client accounts

Summary of rules for the duties related to segregating client funds:

- For each client who has funds on deposit in trust your account, you must maintain a ledger of all deposits and withdraws (payments and/or refunds) made against funds in your trust account.

- To fully account for funds, you must provide 4 pieces of information:

- Amount of funds received and deposited

- List amounts of funds paid or distributed out of the trust account

- List any additional deposits to the client’s trust account

- Show balance of funds still held in trust account.

- Ethics rules require keeping an individual ledger for each client so specific funds can be identified. So make sure you have the ability to do this – even if it is a simple spreadsheet. If accounting and QuickBooks are not your strengths, there are great practice management software packages available today to help you manage these funds and stay in ethical compliance.

- If you accept credit card payments for retainers, how are these transactions getting into your trust account and how are the credit card fees being handled? If you are going to accept credit card payments for retainers, make sure you set up a second deposit account so you can direct these credit card deposits directly into your trust account. Some lawyers get in the habit of taking retainer credit card payments and only having one deposit account – the operating account – with the intention of moving the money from the operating account to the trust account. This is called commingling and is an ethics violation, in addition to creating extra work. Do yourself a favor and set up a process with your credit card company that gives you the ability to deposit credit card deposits directly into your trust account.

- Does your credit card company allow for credit card fees to be deducted from your operating account? If not, are you keeping a reserve in your Trust account to cover these fees and then properly recording them when entering the deposit? (Side note: This is the one exception to the rule regarding lawyers depositing their own funds into Trust accounts; it is acceptable for a lawyer to deposit their own funds into the Trust account to cover the payment of bank fees, including credit card fees.)

DUTY TO NOTIFY CLIENT

When you deposit money or withdraw money to pay for expenses incurred or to pay for earned fees, you have a duty to notify the client upon receipt or disbursement of funds. You may deposit funds when you receive a settlement check. You will disburse funds when you produce an invoice for fees earned and expenses incurred. You have a duty to notify the client and produce a document stating the services you rendered and expenses paid on behalf of the client and the total amount to be withdrawn from the client trust account to cover these costs.

To take it one step further, some states actually require you to give notice to the client of the amount owed before you actually remove the money from your trust account to pay the amount owed. Why is this important? A client is entitled notice of the nature of the fees and the amounts in order to determine whether the client disputes the fees and expenses. Failure to do so could expose you to the risk of a grievance charging that you misused client funds.

So what procedures can you put in place to cover this duty? Here are two suggestions:

- In your fee agreement letter, advise the client of your billing processes and how the money in trust will be used to pay invoices generated for fees and expenses. Explain to the client that they have X number of days to dispute the amount due. If a dispute is not made after the set number of days, state you will use the client trust funds on deposit to pay the amount due.

- Add the information to your billing invoice and/or cover letter. Include the current amount in the client’s trust account, the current amount of the invoice and the amount that will be remaining in trust after the invoice is paid. You can include a message that says the funds will be used to pay the invoice and if the client wishes to dispute the amounts, they should contact you immediately. In some states, you must provide this information at time of billing and applying funds.

After applying the trust funds to the invoice, always send the client an updated invoice, which includes the amount of retainer applied and the balance remaining in trust. If the balance is zero or approaching zero, you should also include a letter requesting additional retainer money be deposited (if you are anticipating more work to be done).

You have a duty to notify your client how and when you used their funds and keep detailed and accurate records. Below is a sample of what you should be including on an invoice where client trust funds were used.

- Invoice detail of work performed (time entries)

- Total amount due (new charges)

- Amount applied to pay the invoice (payment)

- Remaining client trust balance.

DUTY TO PROVIDE FULL ACCOUNTING OF FUNDS

If a client asks for a report showing their retainer balance and how the money has been used, you have a duty to produce this report in a timely fashion. In order to fulfill this duty, a lawyer must create and maintain appropriate records of funds belonging to the client. In simple terms, this is called a client trust ledger, whether you do it manually, in Excel, in QuickBooks or in your law practice management software. Below is a client ledger report from QuickBooks.

This type of report produces a nice audit trail of activity and ensures you are keeping accurate records of client trust funds.

BEST PRACTICE TIP

For solos, in case of your death or disability, plan ahead to protect your clients’ funds.

- Who will sign a trust account check to refund money to a client if you are unable to?

- There is a fiduciary responsibility to disburse client funds timely

Monthly 3-way Trust Account reconciliation

A 3-Way Reconciliation means that your Trust bank balance matches your checkbook Trust balance and they both match the sum of all individual client ledger balances.

- As part of your duty to keep accounting records, you must reconcile your trust bank account on a regular basis. Some states impose the duty to conduct a 3-way reconciliation.

- What is a 3-way reconciliation?

- A 3-Way Reconciliation means that your trust bank balance matches your checkbook (register) trust balance and they both match the Sum of all Individual Client Ledger Balances. Most accountants do not understand 3-way reconciliations. That’s no excuse for your lack of understanding. You have fiduciary responsibilities and you cannot delegate this responsibility. Below is a simple spreadsheet to use for a 3-way reconciliation.

COMMON MISTAKES

Lawyers are personally responsible for all activity, reporting, documentation, and communication regarding their trust account. It is a non-delegable responsibility. So if you are delegating these duties, something you should do if you do not have the skills or desire, you need to be diligent about reviewing the trust account and asking for reports which show you are in compliance. In summary, here are three common mistakes made when handling funds in trust accounts.

Mistake #1: Borrowing Money from Your Trust Account

Your duty to account for funds and segregate.

Money that belongs to your client stays in your trust account until you have earned it and you cannot earn more than you entitled to.

3 Ways Improper Borrowing Can Happen:

- You take trust money before it is earned.

- This happens most when there are cash flow problems and poor or no accounting practices in place. Imagine this scenario. You deposit the client’s retainer into trust. You are required to pay yourself this money when it is earned or costs are incurred. If you don’t it’s called commingling. However, you will not complete all of the work to earn the total retainer amount until next month. You have rent due, payroll to cover, or another contingent fee case is incurring costs you need to pay for. So you move more money than you have earned from the trust account to the operating account and use this money once in the operating account to pay for other business related expenses.

- PROBLEMS ABOUND:

You cannot properly document this unethical behavior because your client would question your intentions when they get a copy of their trust fund activity, thus violating multiple rules:- Failure to notify client of how funds were used

- Failure to provide and keep accurate records

- Commingling client funds with your business funds

- Potentially setting the stage for using another client’s funds when the next client invoice is due.

- You borrow money from client funds with the intention of putting it back.

- Cash flow problems escalate to the next level and you have money sitting in your trust account. There is money from multiple clients and cash flow this month is tight. You have no cash reserves and you need to pay rent. So you “borrow” a little money from your trust account with every intention of paying it back. But you don’t and things snowball. One of your clients wants to fire you and is requesting a refund of his retainer and you don’t have the funds available to promptly pay the refund.

- You are required to refund his money immediately, upon request since you have a duty to promptly pay or disburse client funds. You have done a poor job of documenting which client you borrowed money from and you do not know what the balances are in your individual client trust ledgers. You may have also done a poor job of invoicing this client for fees you earned, so now you have to construct invoices before you refund the money. The end result may be you do not have enough money in your trust account to issue the refund without using other client’s money which is misappropriation of client funds.

- Trust account theft and the duty to safeguard client funds:

- Without good checks and balances in place, someone accesses your trust account checks and manages to write himself/herself a check. It’s important to know who has access to these accounts and who can sign checks. You should keep your checks locked up and always account for missing check numbers.

Tip: Set up an alert on your account to have the bank send you an email every time a check clears your account.

- Without good checks and balances in place, someone accesses your trust account checks and manages to write himself/herself a check. It’s important to know who has access to these accounts and who can sign checks. You should keep your checks locked up and always account for missing check numbers.

BEST PRACTICE TIP

Paying Expenses Related to a Client Matter

Sometimes checks written for filing fees or expert witnesses get lost or never cashed. Since you have to report abandoned funds and un-cashed checks, I believe it is best to pay these types of

expenses out of the firm’s operating account, using client funds you have in trust to reimburse yourself. Best practice is to always pay these expenses from business operating account then

transfer funds to your operating account.

Mistake #2: Commingling Attorney Fund with Client Funds

Your duty to segregate funds and duty to promptly pay or disburse client funds.

The only money that gets deposited into a trust account is client money given to you as a retainer for future fees and/or expenses, settlement checks or restitution checks. If you take credit cards, be sure to set up two deposit accounts with your credit card processor: one for transactions to be deposited into your operating account and one for transactions to be deposited into your trust account. Keep these clearly labeled and identified.

3 Ways Commingling Can Happen:

- Do not write checks from your operating account payable to your trust account. When in doubt, deposit into your trust and then write a check to operating account. For example, you receive a check for $1500, a flat fee arrangement with $1200 for fees and $300 for costs. You deposit all $1500 into the operating account because the majority of it is going to fees, agreed to be earned upon receipt in your fee agreement. However, it is best practice to deposit the entire check into the trust account because the filing fee portion of this check needs to be held in trust. Write a check for $1200 to your operating account and keep the $300 in trust until costs are incurred. When you get the invoice for the costs, do not pay the invoice from your trust account. Write a check to your operating account and then pay the invoice because the invoice for the expense was created under the firm’s name not the client’s name.

- Never use the trust account as a savings account or a place to hide revenue and have all trust account fees deducted from the operating account, such as credit card fees. You cannot write a check out of your trust account to pay bills for overhead expenses, even if you have earned this money.

- When the fee is earned, it is your money and must be withdrawn from the trust account to pay the client invoice, otherwise it is commingling. You can’t use your trust account as a rainy day fund.

BEST PRACTICE TIP

Wait an appropriate amount of time for deposits to clear before writing a check against funds in your trust account.

Verify that the check you deposited has cleared before issuing a check against these funds. This is a common situation in settlement transactions. Clients want their money the same day you

get the settlement check. Don’t do it and know your bank’s policy on holding funds before the funds are cleared.

Mistake #3: Not Properly Tracking Client Funds

Your duty to notify and keep detailed and accurate records.

You have a duty to keep detailed and accurate records that includes keeping an individual ledger or log for each client who has money in your trust account. Most state ethics rules require you keep a balance sheet or ledger on each client so that specific client funds can be identified. These records must show:

- How much money a client has in trust at any given time

- Deposits and disbursements (checks written) with dates

Here’s a suggestion: note the client’s name and file number on each check when it is issued from your trust account. Why? Because you have a short memory. If records get destroyed and you need to reconstruct your trust account history, it will be much easier to do if you know whose money was being used in the transaction.

BEST PRACTICE TIP

Explain in your fee agreement how you apply money held in your trust account toward

legal fees and expenses incurred.

- Explain to your client they will receive a statement or report showing these charges, amount of retainer applied and balance remaining in their trust account.

- Design your invoices to include this information or set-up your accounting system properly with client ledger accounts that track the ins and outs and give you reporting options to

produce detailed transaction reports.