November 2020 (revised from original post) Peggy Gruenke | Originally published in Attorney at Work.

The year-end is right around the corner, along with the holiday season. So, what do you really want for a holiday gift? How about getting paid for the work you did during the year, and focus on year-end collections.

The holidays can be extra hectic for lawyers with the scramble to get money from clients before year-end and tax planning with your accountant. Most law firms operate on a calendar year and are run on a cash basis, meaning work isn’t counted as revenue until clients pay. If you are a partner or even an associate, your compensation may be tied to the amount of money your firm collects on the work you billed. If you are a solo, you know all too well your compensation is directly tied to how much you collect on invoices.

Also during these last few months of the year, there’s typically a slowdown in the number of new cases for many practice areas — divorce, bankruptcy, estate planning, real estate — as people begin to prepare for the holidays and put certain personal and business matters on hold.

The result? A collections sprint as the year closes. Law firms deal with it every year — a large percentage of revenue is collected in the last three months of the year. Could better collection procedures be put in place to avoid this year-end ritual? Of course! But let’s focus on tips to help you get more money in now.

The Collections Plan: Start With Over-Ripe Accounts

Now is the time to look at past-due accounts and figure out where you are leaving money on the table. The tool you will need to assist you is your “aged accounts receivable” report. I suspect this might generate one of the following reactions from you:

- Confusion: as in “Crap, do I even have this kind of report?” (Add “buy accounting and practice management software” to your holiday shopping list!)

- Panic: when you see how very few past-due amounts await collection, and how little cash you have on hand. (Be happy the clients you have actually paid you. Next year, get more clients.)

- Frustration: when you realize how much time collecting past-due money is going to take.

- More frustration: You haven’t set up the ability to accept credit cards for client payments. (Eliminate this frustration now and set up credit cards: Check out GRAVITY LEGAL payment for law firms.)

- Disappointment: that you let past-due accounts get to this point.

- Relief: that you have money to collect!

Putting emotion aside, here are a few things you can start on — this week — to boost your year-end revenue number.

1. Pluck the Fruit That’s Already in Your Hand

Current clients that have invoices 30 to 60 days past due will give you the highest return on investment for the time and energy you devoted to getting paid in these last weeks of the year. But you will need to be proactive to collect.

Ask your current clients about recent invoices. Since they have active cases, you will be having conversations with them anyway, right? So ask: “Did you see problems with their invoice regarding time entries or expenses, or did you have sticker shock?” Don’t be afraid to ask these questions. Avoidance will only lead to writing off or heavily discounting these invoices 60 or 90 days from now.

Ask if they are happy. Your current clients are receiving value from your services, so their desire to pay is higher. At least you hope so. If you are not sure clients are pleased with your services, you need to ask them. They will appreciate your concern and you can proactively avoid non-payment (or a possible negative online review). After all, if they say they are happy and get an invoice from you the next day, they should feel pretty bad about ignoring it.

Bill every two weeks through the end of the year. Billing current clients every two weeks will let you use the money sitting in the client’s trust account. It will also keep the bills smaller and the checks easier to write.

2. Identify the Lowest-Hanging Fruit

Low-hanging fruit would be accounts 60 to 90 days past due. These are still ripe for paying but need attention. First, identify clients that were making payments regularly, but at some point the payments stopped coming. You want to set up a procedure for touching base with them two to four times over the next six to eight weeks, to try to get this money collected.

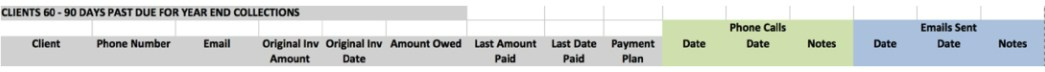

Start by adding these clients to a spreadsheet like the one below. Keep this spreadsheet up-to-date as calls, emails, and conversations take place, so you always have current information and can easily delegate any task. Better yet, if you have law practice management software where you can add notes and set up tasks and reminders – use this feature.

Now the hard part. Pick up the phone and call each of these clients. You may find they have not been receiving past-due notices. If you were inconsistent in sending bills and past-due notices, it will be revealed on this first phone call. You can offer to set up a payment plan to get the debt paid over some specific number of weeks. Or, offer a discount to get the account paid in full — and make sure you allow them to pay with a credit card, right now, while you are on the phone.

Next steps after this first phone call? Follow a process like this:

- Confirm things in writing. If a payment plan was selected, confirm it in writing with an email or letter detailing the amount of each payment and date due. Use your credit card merchant to set up payment plans – your clients can set it and forget it!

- Make it easy to pay. You can get in writing a pre-authorization to charge their credit or debit card, set up an agreed-on amount to submit payment. This can make it easier to adhere to the payment plan. Send the client an updated statement reflecting every payment applied and the amount remaining due, with a handwritten note of thanks.

- Be persistent. If you don’t get a response from the first phone call, start in on the procedure of sending emails and making phone calls weekly until you have received payment or arranged a payment plan.

This may seem like an overwhelming task, but keep in mind how much money is at stake. Need a little incentive? Take out a big sheet of paper and write down your total amount past due and put a picture of your family next to this number. Now, tape that paper where you will see it every day. As payments come in, add them on your piece of paper to visually keep an eye on your progress.

3. Stop Wasting Time on Unreachable Fruit

Some funds are out of reach, so get off the ladder. Say good-bye to this money, write it off as uncollectible and consider it a learning opportunity. There is good data here to use in creating better systems and habits, so spend time during the holidays looking at what went wrong. For example, ask yourself these questions:

- Did you ask for and get a retainer?

- Did you get enough of a retainer?

- Should you have set up a minimum balance retainer?

- Did you bill regularly?

- Did you send statements of account to clients with open balances?

- Did you acknowledge the fact that the client wasn’t paying and address this issue or did you choose to ignore it?

- Did you have a process in place to collect on past-due accounts?

It could be that this whole process is something you have no time or patience for. But don’t throw in the towel. Your secretary could assist you, or you could outsource the task to a local bookkeeper or virtual assistant. CPN-Legal provides these services and can help you become more profitable before year-end,

Implementing these tips should get you paid faster. It’s painful, maybe that’s a good thing — it will motivate you to put better collection procedures and habits in place for 2021.