Handling settlement funds correctly has a distinct flow. Not sure how that flow should go? Don’t worry! We’ve put together these steps to walk you through the process.

Onward to the steps!

All settlement funds must be deposited into firm’s IOLTA account and verified as cleared deposits before checks are written against funds.

- Complete a Check Request Form before issuing settlement checks. Include copy of court settlement agreement.

In Clio, during engagement, add all expenses firm paid to Clio under Activities>Expenses.

Adding settlement funds, disbursing settlement fees to 3rd parties, paying the firm for their portion and disbursing the funds to the client

All checks written in QuickBooks must be accounted for in Clio.

- In Clio, add the settlement finds/check to the matter, from the matter dashboard, under Transactions

- In QuickBooks, deposit the Settlement Check into the Trust Bank account.

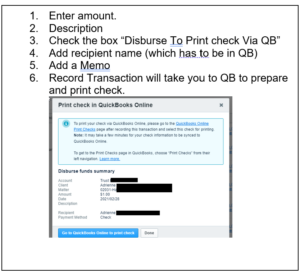

- In Clio, disburse funds to 3rd party and/or client. From the Matter Dashboard, select Transactions > Select IOLTA account > Disburse Funds

In QuickBooks, you will be prompted to print the check. You can save can print later.

- In Clio, Prepare Invoice for law firm fees and expenses

- On the Matter expense tab, verify all expense checks written in QB for any client expenses paid out of operating account have been recorded in Clio

- On the Matter Dashboard, update the Award for Fees

-

- Generate Clio Invoice which will have all expenses and attorney fees as determined by the settlement agreement.

- In Clio, pay Invoice by applying trust funds to invoice.

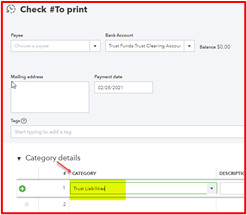

- In QuickBooks, “write” check to transfer the funds earned to Operating account.

- Be sure to CATEGORY Client Trust Liability account.

- In QuickBooks, go to Bank Deposit screen to record the payment/deposit into the OPER account